Newsletter

Thu Dec 29 2016

Market moves in cycles and always self-corrects, although it can take very long to do so especially with too much liquidity from the years of QE sloshing around in the system. Many financial market participants were “shocked” by the post Trump market movements. What we saw was merely an unwinding of an expensive asset class waiting to happen, and Trump was the catalyst. The unwinding of negative sovereign yield was bound to happen, regardless of Trump. In investments, it is important to take this into perspective. As investors we do not predict the market, we look for disconnections to uncover undervalued assets to buy and overvalued assets to sell.

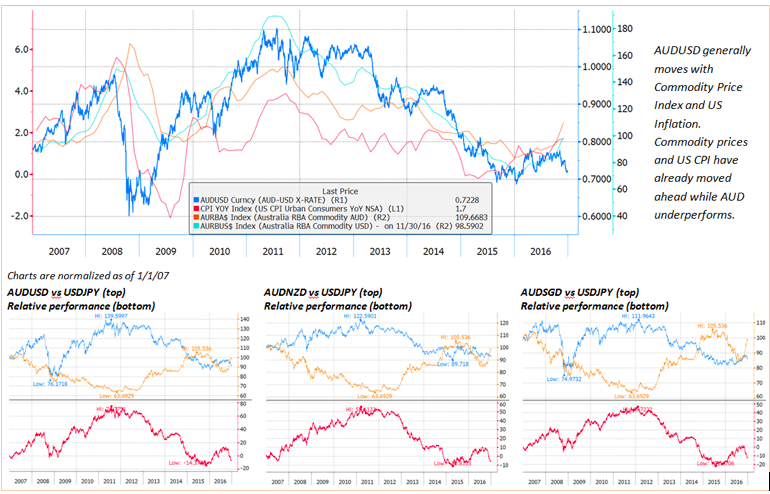

What is the misconnection we are seeing? If growth falls short of what is priced by the market, USD will weaken. And if growth does happen, FED’s hand might be tied and fear of runaway inflation expectations will build up. Given the current reflationary theme, it is perplexing that the proxy for growth, AUD, is underperforming the market. Market is actually pricing in a stagflation scenario on a broad level. Holding USD cash to buy US equity becomes a popular barbell trade in this scenario.

If market is right and growth is coming, growth currencies will rally and interest rates will rise faster. If growth is lower than market expectations, USD will weaken. In both cases, US equity is limited by its own upside. EM equities are a better play if we expect growth to flow through. So a basket of USD and growth currencies and gold, with Japan and EM equities will be a good portfolio to start the year. This portfolio construct should be watched and reviewed closely because we are at the threshold of change after 7 years of QE.

Big Trend

On the technology front, this year will see increasing adoption of AI into more aspects of our lives. Driverless cars, drone delivery, robotics, AI assisted manufacturing and e-commerce, AI assisted trading and payments, AI security, etc. We are only witnessing the beginning of adoption of AI. We are well invested in the AI space in Developed World market, and this year we will look into AI in China, a still nascent market for AI due to its talent pool constraints.

Last but not least, Social Impact Investments is an area ICH will be committing some of its resources going forward. This is an area which is driven not so much by its near-term financial returns than by the new Millennials entering the job market – Millennials are motivated differently and having been brought up in a world of abundance, they see the world differently. As a firm, this is an area we cannot afford to sit out.

ICH