Q4 2025 Investment Outlook: Low Volatility, High Tension

Mon Oct 06 2025

Dear readers,

In recent months, volatility has slipped to multi-year lows – the VIX now hovers near levels last seen before the pandemic, reflecting a market that appears tranquil, confident, and almost self-assured. Yet beneath the surface calm, tensions are quietly rebuilding.

In our last 2 newsletters, we highlighted the trigger for asset managers globally repositioning for a weaker USD and diversifying away from US assets.

Since then, the major global markets across the world have generally hit all time highs. India remains an outlier, but even there the optimism hasn’t really faded.

What surprised us was the resilience of the US market despite these global reallocation flows. The continued strength of the US economy and a Federal Reserve cutting rates together with the confidence that Donald Trump Always Chicken Out trade – the market’s growing belief that the US establishment will prioritise growth over confrontation – these strong tailwinds continue to underpin the capital markets performance in the US. The success of new IPOs and continuous surge in M&A deals further reinforce investor confidence. It’s a reminder that the world can be both reallocation away from the US and still buying into US dynamism.

China and the Region: The Next Phase

Going into Q4, our conviction remains firm. We continue to be bullish on China, especially the leaders in AI but selectivity matters, and we stay cautious on segments exposed to over-production competition.

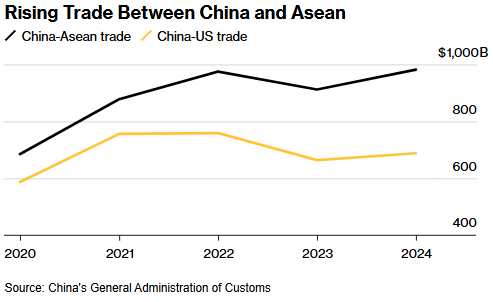

Beyond equities, the macro backdrop in Asia is shifting in important structural ways. Roughly 20% of total trade between China and Southeast Asia is now transacted in RMB, and this proportion continues to rise.1 This is more than a currency trend, reflecting a quiet re-engineering of the region’s financial plumbing. As US tariffs and protectionism mount, Asian supply chains and payment systems are adapting. The surge in intra-Asia e-commerce, EV, and emerging-tech trade is fueling demand for RMB settlement, strengthening local-currency linkages, and reinforcing the trend of de-dollarization.

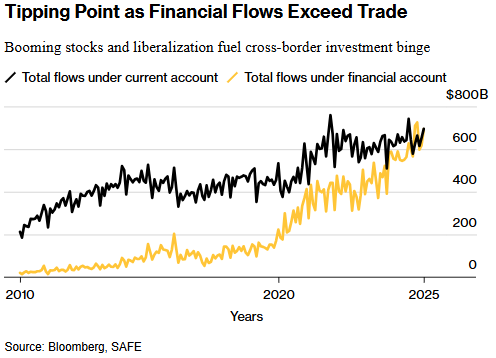

Back in 2001, China’s entry into the WTO reshaped the world’s manufacturing landscape. Two decades later, we may be witnessing an equally significant turning point – this time in capital flows rather than trade. For the first time, the amount of capital moving in and out of China for investment has begun to exceed the value of its trade in goods and services.2 This marks the early stages of a transition towards financial dominance, where cross-border investment, rather than trade, becomes the dominant channel of global influence. In developed economies like the US or Japan, such flows outnumber trade by ten to one.3 China isn’t there yet, but the direction is unmistakable and could profoundly reshape Asia’s investment landscape over the next decade.

The Real Asset Rotation

We maintain a bullish stance on real assets, particularly metals as a key holding.

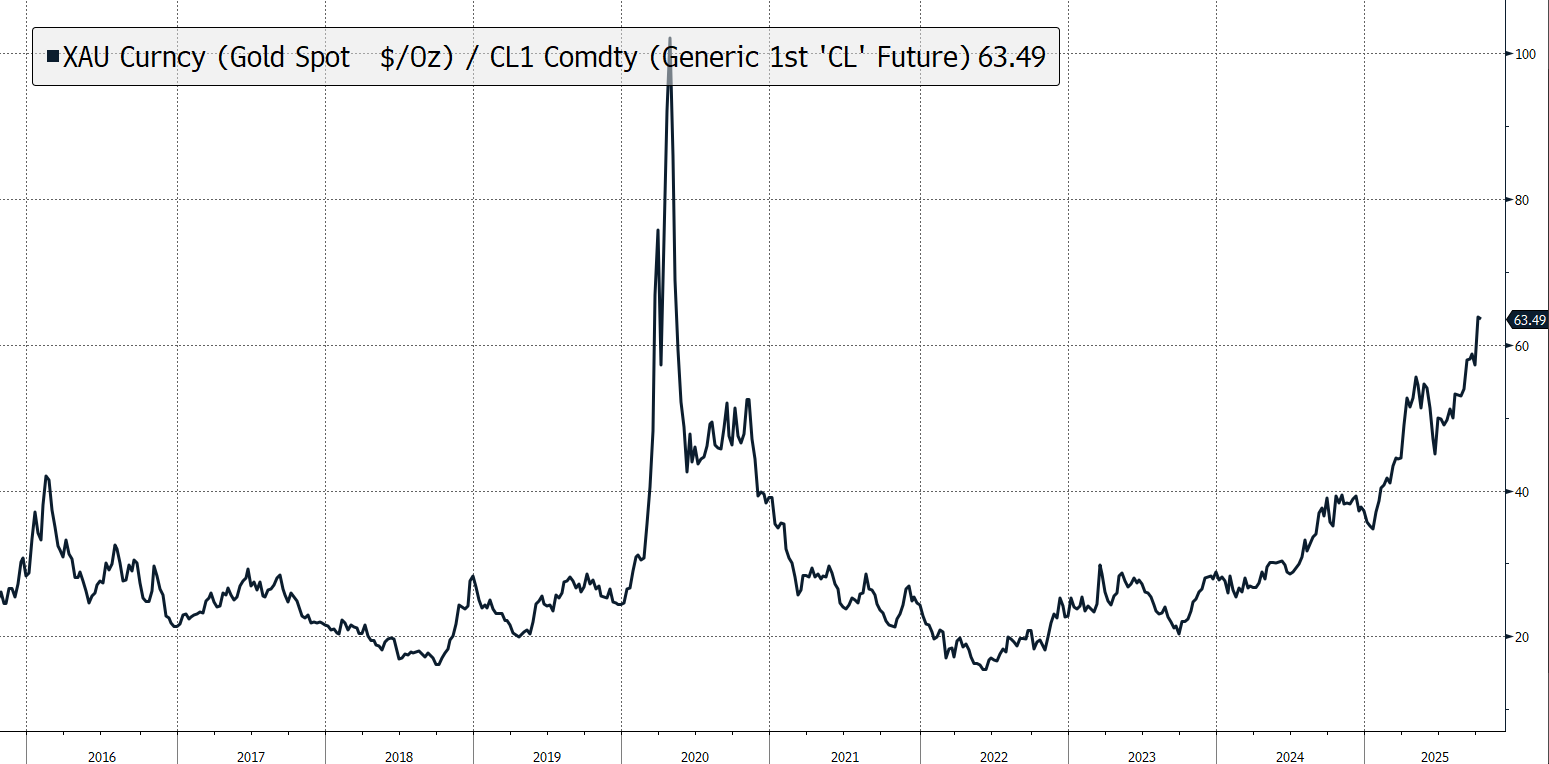

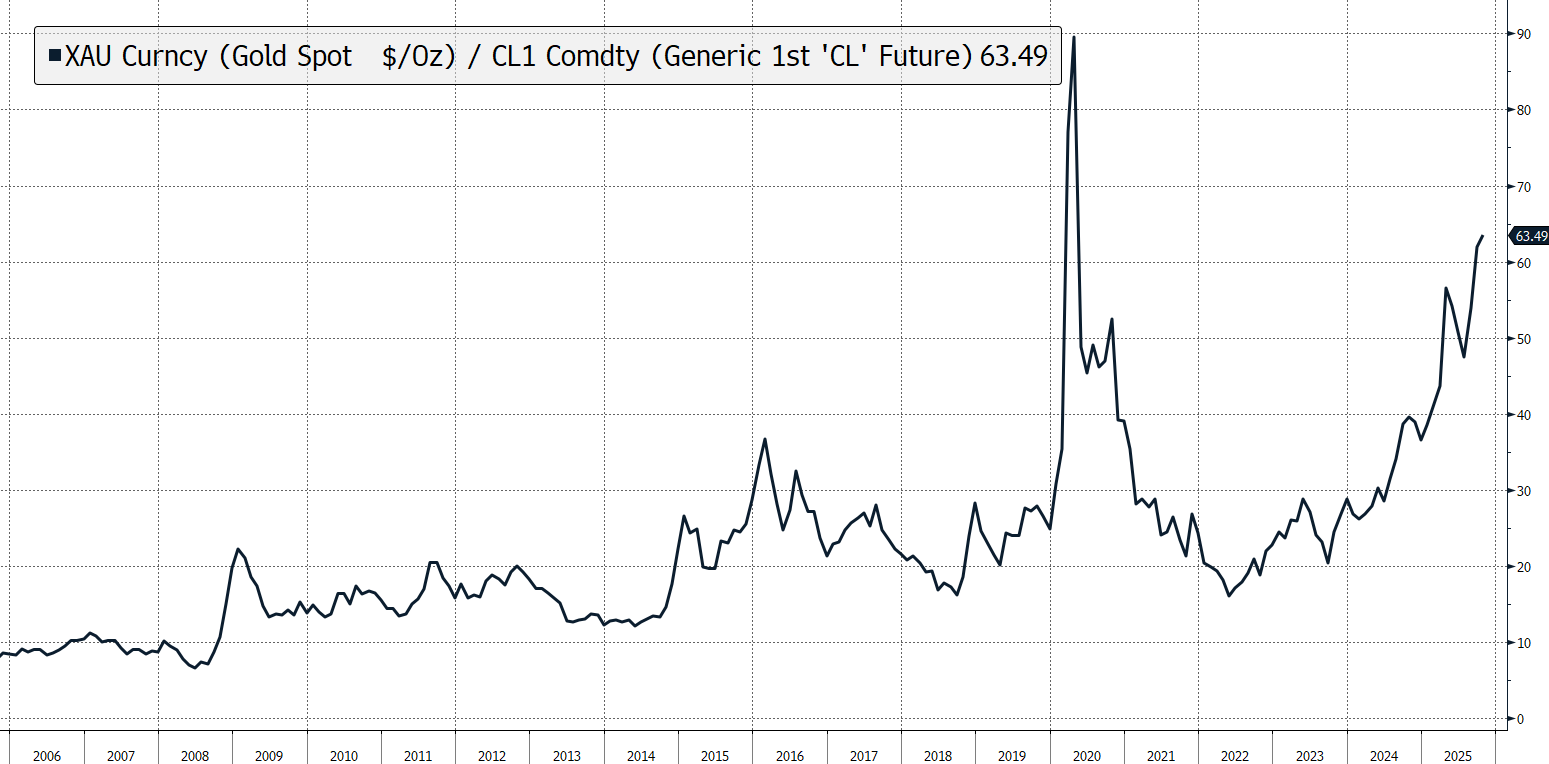

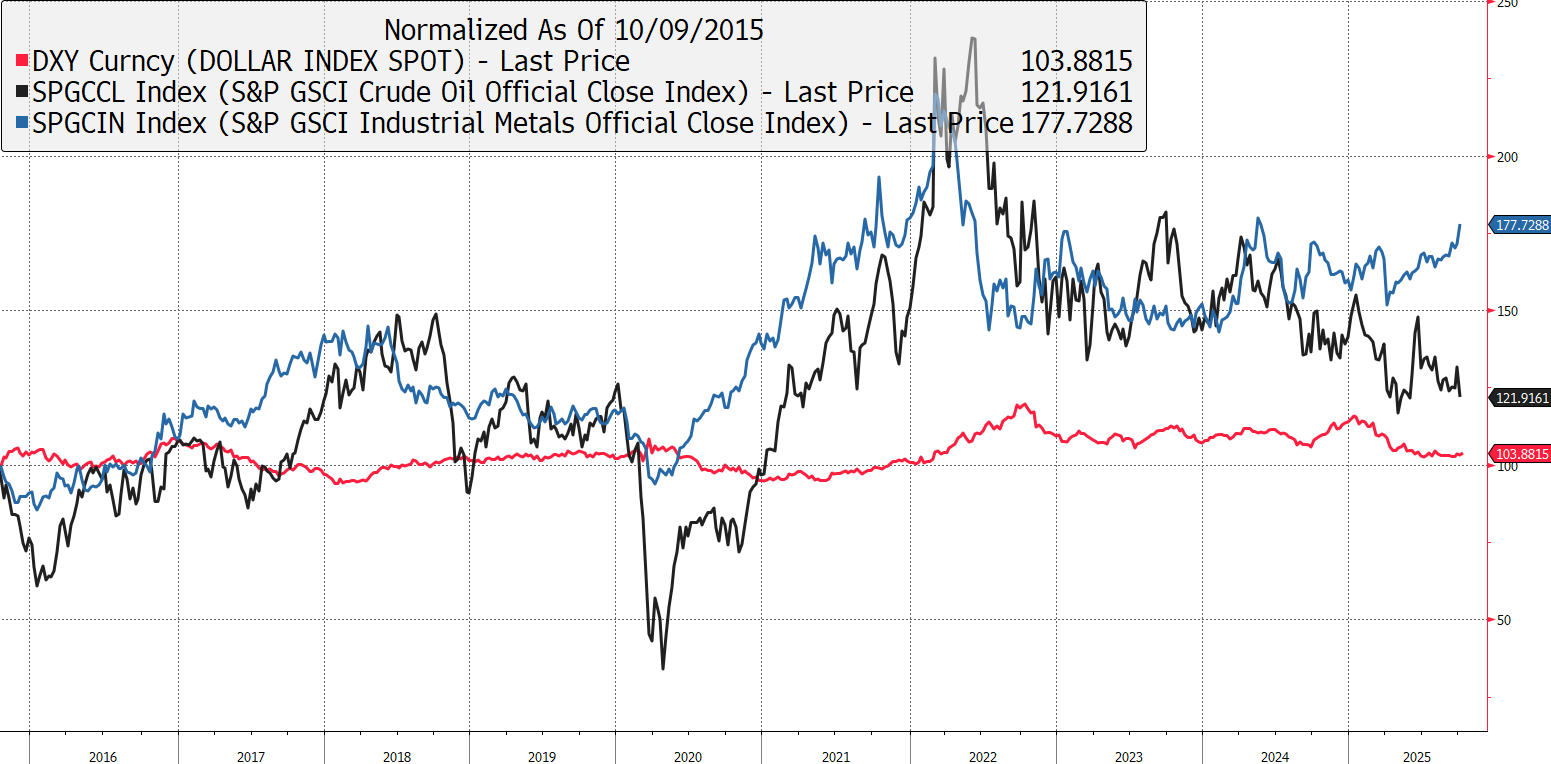

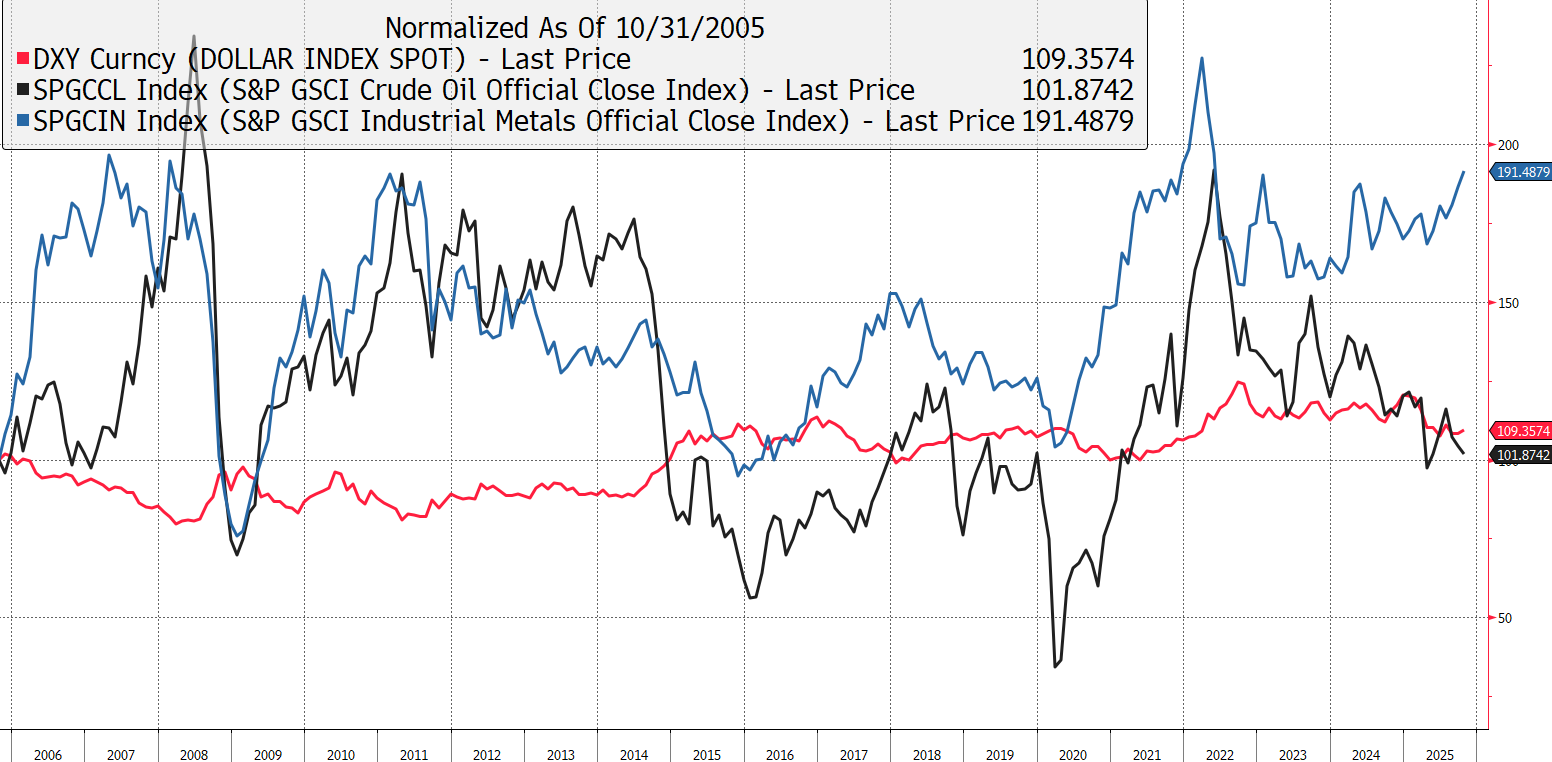

We have turned tactically bullish on Oil, viewing current levels as attractive in risk-reward terms as the Gold/Oil ratio approaches historical extremes. And along with the widening gap in performance between industrial metals and Oil, is a set up for potential mean reversion.

Gold/Oil Ratio, 10 Years, Bloomberg

Gold/Oil Ratio, 20 Years, Bloomberg

DXY vs S&P GSCI Crude Oil Official Close Index vs S&P GSCI Industrial Metals Official Close Index, 20 Years, Bloomberg

DXY vs S&P GSCI Crude Oil Official Close Index vs S&P GSCI Industrial Metals Official Close Index, 20 Years, Bloomberg

Lastly, we expect inflation pressures to likely re-emerge, becoming a key theme heading into 2026, hence the importance of positioning the portfolio with real assets and inflation hedges.

1 https://www.bloomberg.com/news/articles/2025-08-28/uob-can-t-get-enough-yuan-as-usage-soars-in-southeast-asia

2,3 https://www.bloomberg.com/news/newsletters/2025-09-11/china-s-4-5-trillion-flows-mark-potential-new-era-for-the-global-economy

Chairman